ONESOURCE India GST Compliance

Transform India GST Compliance with ease

Achieve seamless GST compliance with our agile cloud based solution. Automate processes for timely, accurate filings, enhancing efficiency and ultimately derisking your compliance for future.

Streamline GST compliance

Automate your compliance processes to ensure accurate, timely filing, maximise ITC, generate e-way bill, e-invoice and manage vendor payment within the tool.

Adapt quickly to regulatory changes

Stay ahead with our agile solution, tailored for evolving regulations with dedicated modules such as Invoice Management System (IMS) and Input Service Distributor (ISD).

Seamless & robust ERP integration

Our solution has robust ERP integration which make GST compliance journey more easy. Comes with in-built SAP integration capabilities.

Minimise and manage litigations

Reduce compliance risks and manage existing GST litigation effectively with our Litigation Management tool and robust automation.

Optimise GST compliance: embrace cloud for efficiency

Compliance anywhere

Stay compliant effortlessly with automatic updates to rules and rates. Our platform ensures precise and timely VAT/GST submissions, adapting seamlessly to regulatory changes.

Data security and privacy

Protect your GST data with robust security measures. Safeguard sensitive information and ensure compliance.

Efficiency and Accuracy

Enhance your operations with seamless ERP integration. Swiftly reconcile your documents for error-free records.

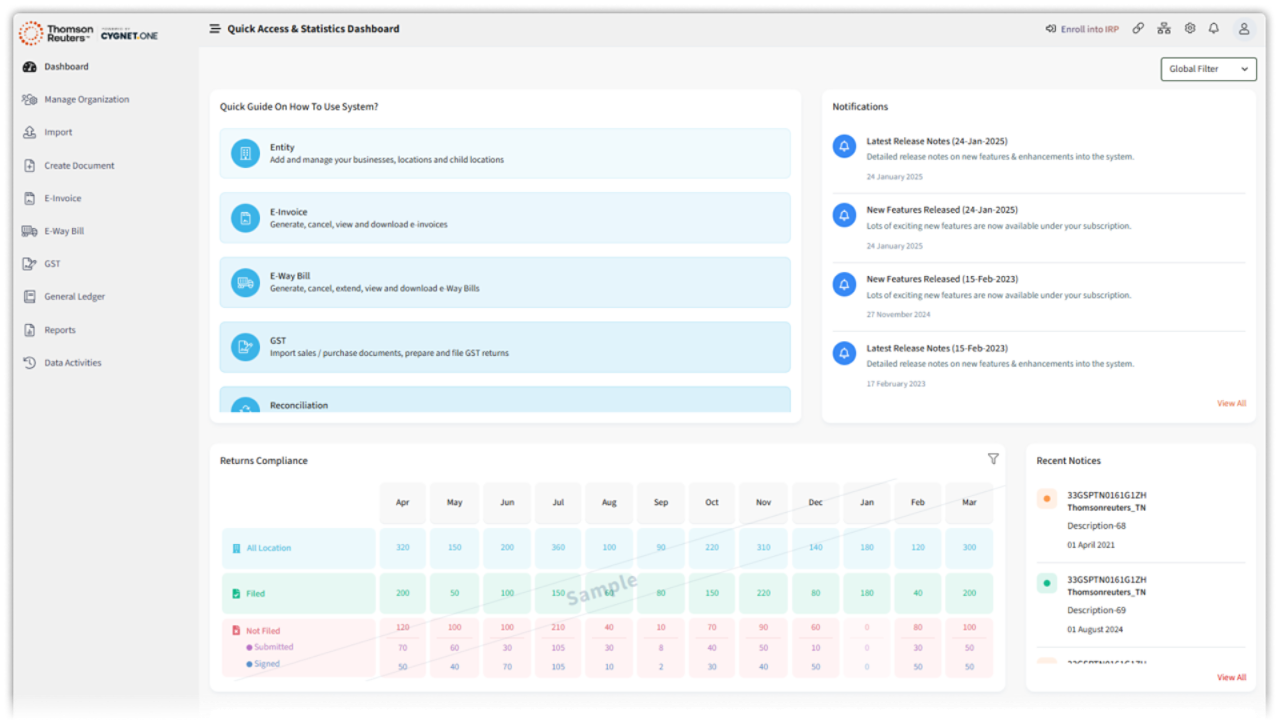

Better decisions with concise reports

With our advanced analytical reports and interactive dashboards, empower your teams by gaining actionable insights to optimise your GST compliance processes.

All-in-one GST return e-filing platform

Simplify your GST filing with an all-in-one platform. Import data, reconcile discrepancies, and e-file returns (GSTR 1 to GSTR 9C) - all in one place.

From reconciliation to vendor management

Avail maximum and accurate ITC (Input Tax Credit) with AI enabled GSTR-2B & IMS reconciliation capability. Manage vendor communication effectively.

Talk to an expert

Explore automated solutions to boost India GST compliance. Stay ahead with our agile, regulation-ready modules like IMS & ISD.

Frequently asked questions

The solution offers robust integration with ERP systems such as SAP and Oracle, enabling automatic data flow between systems, through APIs and Secure File Transfer Protocol (SFTP). This helps in reducing repetitive manual tasks and thus errors. This aligns compliance processes with your financial and operational data for streamlined GST management.

Designed for agility, the cloud based solution is updated to reflect the latest changes in GST regulations, e.g. IMS and ISD. This ensures your compliance processes are always current, reducing the risk of penalties. By quickly integrating new requirements, the platform keeps your business compliant and ahead of regulatory shifts.

The IMS module offers configurable actions which helps in generating GSTR-2B. Apart from actions available in GSTN portal, the solution provides flexibility to configure results for no-action. It is further enhanced with real-time fetching of invoices and advanced reconciliation.

The ISD module helps in distribution of ITC and performs reconciliation before GSTR-6 filing. With strong ERP integrations, it significantly reduces manual effort done for distribution of ITC, through one-time mapping.

The solution leverages AI for GSTR-2B reconciliation, delivering enhanced accuracy with minimal manual input. Unlike most solutions that reconcile 75-80% of 2B data, this solution uses evolving AI algorithms to achieve over 96% reconciliation.

The solution facilitates vendor communication to optimise ITC availability. Users can send emails to vendors if discrepancies are found in their filed records that block ITC. If a vendor's email ID is unavailable, the platform triggers a notification, visible to the vendor upon logging into their GSTN portal.

The Litigation Management tool streamlines GST litigation by centralising the organisation and tracking of cases, deadlines, and documents. It offers comprehensive insights into case status and progress, enabling effective strategy and minimising risks. Additionally, it allows legal advisors to provide input, serving as a unified repository for all GST notices.

Related products

Real-time rates, rules and indirect tax content managed by intuitive software so you can save time and mitigate risk.

Tax calculations in milliseconds with automation of VAT, GST, sales and use tax and excise tax using accurate rates and rules

Comply with global e-invoicing mandates – leveraging an integrated online invoice management and indirect tax solution.

Experience it for yourself

Explore automated solutions to boost India GST compliance. Stay ahead with our agile, regulation-ready modules like IMS & ISD.

Have questions? Contact a representative