Tax and Accounting

Tax compliance solutions

Improve your tax workflow time and data management process

Increase productivity with these tax compliance solutions from Thomson Reuters

Professional tax preparation software with a full line of state, and local tax programs that will boost the efficiency of your organisation.

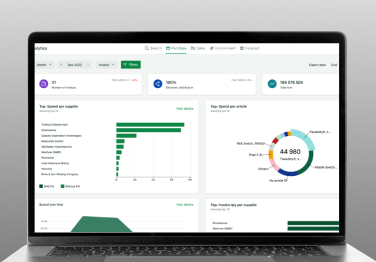

Simplify and Automate Global Sales, GST, and VAT Tax Compliance

Automate your company's sales and use tax, GST, and VAT compliance and expedite your global indirect tax compliance obligations. Move beyond complicated, country-specific spreadsheets to stay compliant across the globe.

Automate BEPS Pillar Two Tax Compliance for 190+ Countries

Minimise risk and get operationally ready for BEPS 2.0 using cloud-based automation of OECD Pillar 2 tax calculations with rules from 190+ countries.

E-Invoicing Compliance Made Easy

Comply with global e-invoicing mandates - leveraging a fully integrated online invoice management and indirect tax solution.

Related solutions

Disclosure Management

Standardise and automate global financial statement preparation

Financial Close

Streamline the tax provisioning process by accessing all relevant applications in one central location

Tax Automation

Automate sales and use tax while streamlining the tax provision process so you stay compliant with your business tax returns

Tax Preparation

Become a valuable resource for your organisation with leading tax preparation software from Thomson Reuters